idaho child tax credit 2021

Qualifying expenses from a 529 Education Savings account now include K-12 and private schools. Recent laws have changed some 2021 income tax instructions.

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

For your 2021 tax return the cap on the expenses eligible for the credit is 8000 for one child up from 3000 or 16000 up from 6000 for two or more.

. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 3000 for children ages 6 through 17 at the end of 2021. Idaho Illinois Pennsylvania Rhode Island.

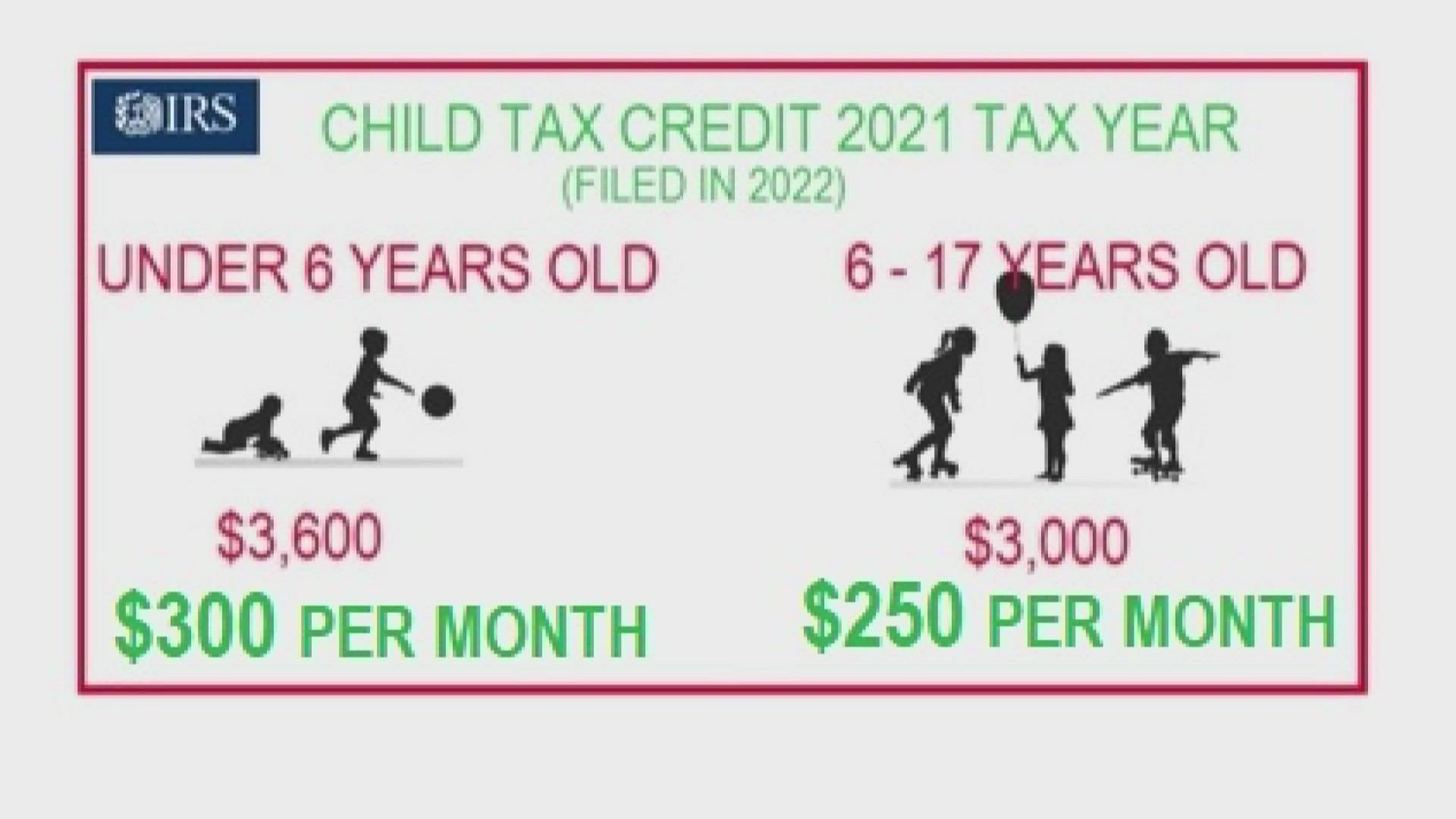

Tax Credits Hiring Incentives. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the. What exactly is the child tax credit.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Idahos income tax rates have been reduced. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022.

On March 12 2018 Governor Butch Otter signed legislation to enact a state-level Child. 3600 for children ages 5 and under at the end of 2021. 205 per qualifying child.

Visit the Income Tax. Get your advance payments total and number of qualifying children in your online account. Child tax credit allowances are.

Enter your information on Schedule 8812 Form. Prior to this years. Typically the child tax credit is distributed annually as a deduction for how much a family owes on their income taxes.

The amount of Idaho income tax to withhold is. File and pay Idaho sales and use tax. The American Rescue Plan only boosted the child tax credit through the end of 2021.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual.

More than and Less than 1 965 000 EPB00744 07-07-2021 Page 2 of 3 Table for. A childs age determines the amount. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic O.

1 For taxable years beginning on or after January 1 2018 and before January 1 2026 there shall be allowed to a taxpayer a. For individual income tax rates now range from 1 to. Have been a US.

Parents income matters too. CHILD TAX CREDIT CTC Rate Nonrefundable. Your Idaho drivers license number state-issued ID number or 2021 Idaho income tax return.

To reconcile advance payments on your 2021 return. The corporate income tax rate is now 65. Workforce Development Training Fund.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. The law raised the credit amount from 2000 to 3600 per child under age 6 and. The enhanced credit which was created by the Democrats 19 trillion coronavirus relief package in March is expected to cut child poverty nearly in half for 2021.

Lower tax rates tax rebate. Raising the qualifying age for the Idaho child tax credit. Work Opportunity Tax Credit.

You must be an Idaho resident to receive the grocery credit. Idaho has a new nonrefundable Idaho child tax credit of 205 for each. Philadelphia Internal Revenue Service 2970 Market St.

The 500 nonrefundable Credit for Other Dependents amount has not changed. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Khou Com

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

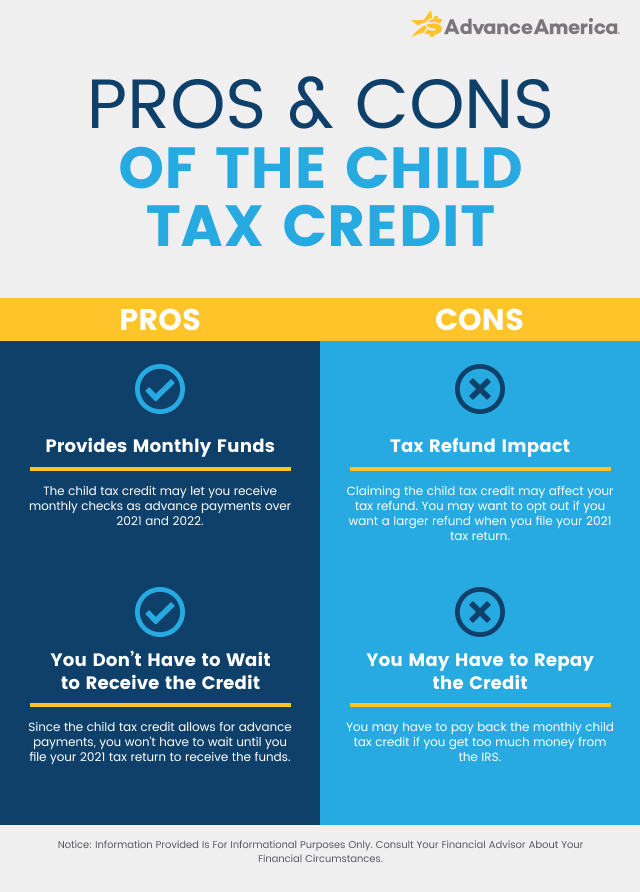

Should I Opt Out Of The Child Tax Credit Advance America

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

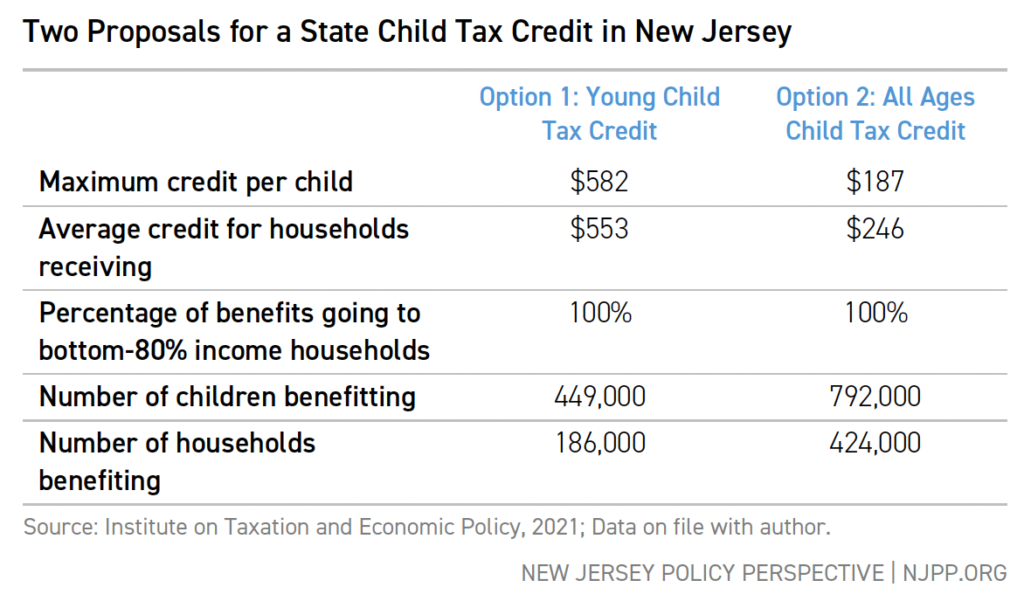

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

Child Tax Credits The 12 States Are Offering Worth Up To 1 000 In Payments To Parents Marca

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

Gop States And Wisconsin Get A Big Chunk Of Biden S Child Tax Creditpage 1 Of 0

Idaho Center For Fiscal Policy With The Passage Of The American Rescue Plan Act More Working Families Will Qualify For Refundable Tax Credits In 2021 For Families With Children The Child

Child Payments Who Can Claim Direct Payments In These States Marca

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Idaho Statesman

The Federal Geothermal Tax Credit Your Questions Answered

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Report Measuring The Child Tax Credit S Economic And Community Impact Niskanen Center

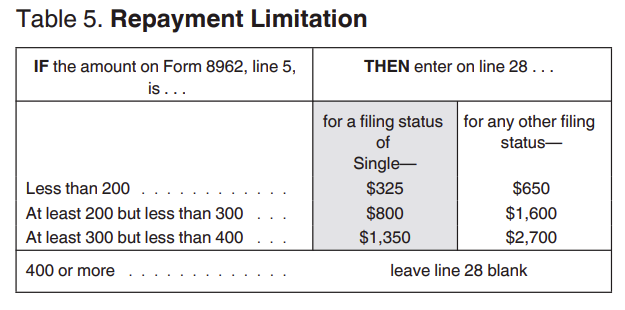

Advanced Tax Credit Repayment Limits

Child Tax Credit 2021 What To Know About Monthly Payments Money