tax benefit rule quizlet

Benefits Received Rule. The idea is that the.

Tax Chapter 9 Inclusions In Gi Flashcards Quizlet

In tax terminology the phrase tax benefit rule refers to whether or not a refund or recovery received in a future year is taxable.

. Tax benefits include tax credits tax deductions and tax deferrals. The important question is whether the taxpayer receives economic benefit. Learn vocabulary terms and more with flashcards games and other study tools.

Statement 2 - Eminent domain is inferior to non-impairment clause of the constitution. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the.

- taxable to recipient deductible for person paying. What is the Tax Benefit Rule. Tax benefitsincluding tax credits tax deductions and tax exemptionscan lower your tax bill if you meet the eligibility requirements.

Define the term constructive receipt. Refund received or the difference between standard deduction or itemized deduction. His taxable Social Security benefits are the lesser of a 2500 50 percent of his Social Security benefits or b 50 percent of 24000 modified AGI 2500 50 of Social Security.

When spouses separatedivorce person who was earning income in marriage must pay spouse who wasnt for a certain period or life. Quizlet flashcards activities and games help you improve your grades. Study Losses and Tax Benefit Rule flashcards from Carson Parkss class online or in Brainscapes iPhone or Android app.

A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the government. In 2020 the Orange Fumiture Store an accrual method sole proprietorship sold furniture on credit for 1000 to Sammy. Equivalently stated taxpayers must include.

So the tax benefit you received from the 300 refund was only 225. The Tax Benifit Rule. Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not.

Legal Definition of tax benefit rule. Of course if you were not able to itemize for 2012 none of your state tax refund is taxable for 2013. For example whether or not a state income tax.

Learn faster with spaced repetition. As per tax benefit rule for the given case taxable refund will be lower of. Statement 3 - As a rule taxes.

Tax benefit rule quizlet Wednesday March 9 2022 Edit. 2100 or 29450 itemized. If an amount deducted as an itemized deduction in one year is refunded in a subsequent year it must be included in.

How does the tax benefit rule apply in the following cases. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later. Start studying Tax Benefit Rule Assignment of Income Doctrine.

Under the concept of constructive receipt income. The tax benefit rule allows a taxpayer to deduct or receive a tax credit for repaying income that the taxpayer paid tax on in a prior year. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross.

Rules study guide by awgivens includes 132 questions covering vocabulary terms and more.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Eco2023 Ch 8 The Costs Of Taxation Flashcards Quizlet

61 Gross Income General Concepts And Interest Flashcards Quizlet

Evista Has The Particular Benefit Of Quizlet The Women Had A Reduction In Vertebral Fraction With Visa

What Is The Tax Benefit Rule The Benefit Rule Explained

Done Income Tax Test 2 Chapter 6 Flashcards Quizlet

Ch 12 Tax Credits And Payments Flashcards Quizlet

Fed Tax Outline Flashcards Quizlet

61 Gross Income General Concepts And Interest Flashcards Quizlet

California Tax Expenditure Proposals Income Tax Introduction

Module 9 State Income Tax Base Ii Flashcards Quizlet

Tax Accounting Chapter 5 Flashcards Quizlet

Tax Chapter 9 Inclusions In Gi Flashcards Quizlet

Lesson 8 The Charitable And Martial Deductions Flashcards Quizlet

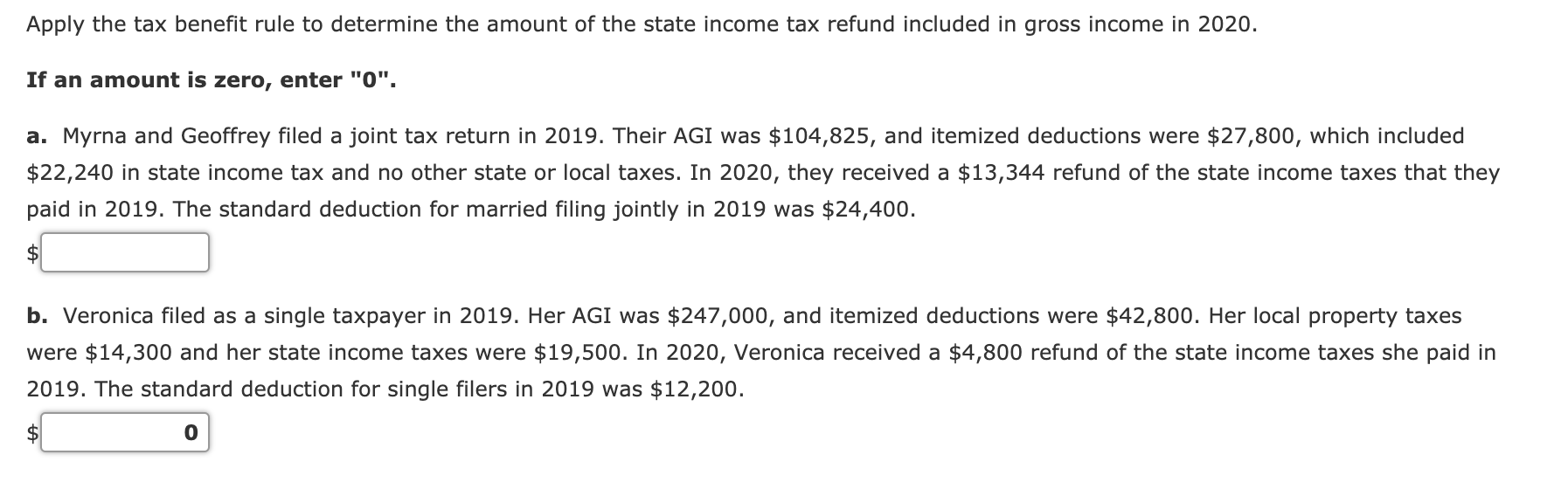

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com